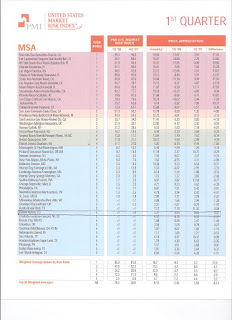

For the third straight month, at least 15 of the nation's 20 largest real estate markets showed relative monthly improvement in May 2008, according to the Case-Shiller Home Price Index.

For the third straight month, at least 15 of the nation's 20 largest real estate markets showed relative monthly improvement in May 2008, according to the Case-Shiller Home Price Index.I use "relative monthly improvement" as another way of saying that some of the more distressed markets are "less worse than they were", but that's still good for the housing market (although you wouldn't know it by looking at the headlines).

Now, it's not wrong to look at annual trends in home prices, it's just a little bit misleading. Remember: many home buyers, especially at the lower price points, are seeing something completely different from what the papers are saying they should be seeing.

Year-over-year comparisons are fine for identifying long-term trends, but as it relates to an active home buyer, annual data is more interesting than relevant. It's the short-term trends that matter.

The obvious example: If you've been shopping for an entry-level home over the last 3 months, you have seen a dramatic increase in competition.

When you see "all the good homes" go under contract quickly, it's an affirmation that buyers have got their confidence back. When buyers start to outnumber sellers, that's the moment prices turn around.

In other words, if you're buying a home now, the real estate market of 12 months ago is irrevelant. What you're going to pay for a home is based on market activity today, not activity from 2007.

CASHFLOW IS GREAT - BUT IS NOW A GOOD TIME TO INVEST?

CASHFLOW IS GREAT - BUT IS NOW A GOOD TIME TO INVEST?