So far, 2016 is looking a lot like 2015.

Three weeks

into the year and we are back into frenzy mode, with multiple offers the norm

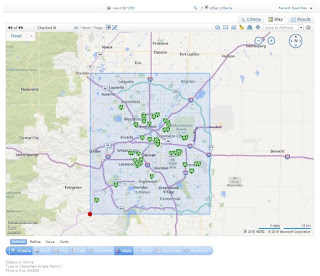

for almost everything in the Denver metro area below $500k that isn’t falling down.

The market

is overflowing with frustrated buyers chasing limited inventory, just as it was

in 2013, 2014 and 2015. While I do think

election-year fear mongering and a deflating stock market will cause some

slowing in the second half of the year, slowing isn’t the same thing as stopping.

The bottom

line is that it will take something pretty catastrophic for us not to have another

solid year of appreciation, meaning that whatever you’re chasing for $400k

today is going to cost you a lot more if you wait until next year.

How much,

you ask?

Well, if you

assume just 5% appreciation on a $400k purchase price over the next 12 months,

that’s $20,000. Divided by 366 days (it’s

a leap year), that works out to $54.64 per day for each day you wait.

No luck

today? That’s $54.64. Nothing tomorrow? That’s $109.28. Wait a week?

That’ll be $382.51.

In fact, if

you really want to make this hurt… consider what your mortgage costs would be

on a $400,000 home if you closed on one this afternoon.

Assuming a

20% down payment, that’s a $320,000 mortgage at 4% (rates are actually better

than that right now, but I want the illustration to be conservative). That payment works out to $1,528 per

month. Throw in $300 per month for taxes

and another $150 per month for insurance, and your total payment is

$1,978.

Multiply

that by 12 months and you get total annual payments of $23,736. Divide that by 366 days (leap year) and you

get $64.85 per day.

So if you

buy today and home prices go up 5% - a conservative estimate by almost every

projection – your actual cost of home ownership for 2016 is about $10.21 per day, plus

utilities. All of a sudden, the numbers make a little more sense, don't they?

If you're renting a comparably-sized house, your rent is likely $80 per day or more, and you're getting none of the tax deductions reserved for home owners.

If you're renting a comparably-sized house, your rent is likely $80 per day or more, and you're getting none of the tax deductions reserved for home owners.

I only share

this to frame the potential opportunity cost of waiting for the return of a

market that has long since moved on.

Facts are

facts, and the fact is that buying a home in the Denver metro area is not

necessarily a pleasant experience anymore.

It’s stressful when you find yourself sometimes waiting in lines two or

three parties deep just to get in to see a house.

It’s

frustrating to finally find “the one”, only to learn that seven other buyers

have already written offers.

But the

people who are having success in this market – the ones who are going under

contract and going to closing – those people are looking forward, not

backward.

If competing

scares you, or if you are worried that there’s a trap door under the market

that somebody standing behind a curtain is just waiting to pull the lever on…

then just back away right now. Go sign

another lease. Or move to a more

affordable locale.

Because in

Denver, big money is showing up and it’s ready to buy, now.

Truth is, there has never been a 10-year window where home values have gone down in Denver, ever, We all want the deal our friend got in 2012, but it’s not going to

happen. Record low inventory. Unemployment rate of 3.3%. Nearly 100 people a day moving here from

California alone. CU Leeds projecting

population growth of 95,000 in 2016 with more than 8,000 new jobs being created

every month.

Where are all these people going to live?

If those

numbers are real, then so is the value in this market, even at 2016

prices.